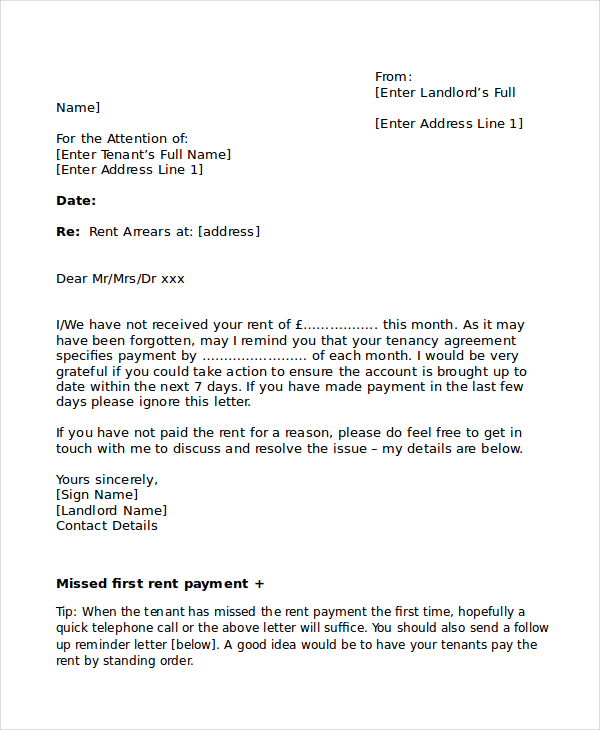

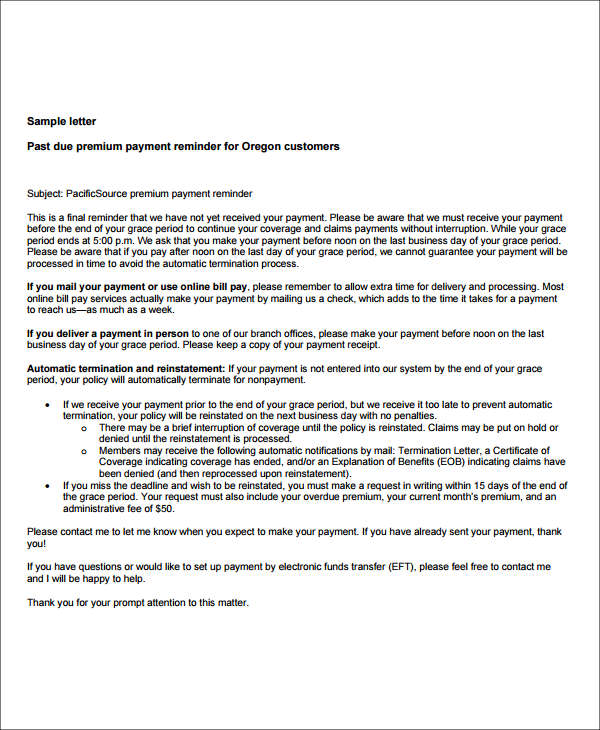

Please let me know if you have any problems or questions. Additionally, here’s a quick link I’ve created so you can add the due date to your calendar: It would be great if you could confirm with me when the payment is made. I’ve attached the original invoice to this email. Subject: Upcoming payment for Hi, Hope you’ve been doing well since we last spoke! This is a friendly reminder that for is due. Who knows, maybe your client really forgot about the due date being on that very day. This is crucial, since it can help you avoid getting a late payment altogether. The first step is easy –all you need to do is write a short, friendly message to remind your client about the upcoming due date. A stern reminder 2-3 weeks after the due date before taking legal action.A polite letter requesting overdue payment 1 week after the due date.Another brief reminder email on the due date.A brief ‘upcoming payment’ notice a few days before the due date.The best way to go about this is to have a steady schedule for sending out these messages, so you can keep track of them easier. This will undoubtedly add more workload to your freelance business management, but needs to be done nonetheless. If you aren’t a user of comprehensive invoicing and payment collection services like Ruul, you’ll have to send your unpaid invoice reminder notices and emails manually. Creating a schedule for unpaid invoice reminders Learn more about our invoicing solutions and payment collection features to see how much Ruul can help you. This way, you can send invoices to your clients, track due dates, automatically send reminder emails, manage your collected fees, and more–all from one place. To make all of this a lot easier, it’s necessary to use a smart and comprehensive third-party invoicing service. Which is why you definitely shouldn’t hesitate to ask your clients for overdue payments. But, no matter what, your well-being and financial security is far more important than taking a potential hit to your reputation. You might be thinking that insisting too much can hurt your relationship with them. This is why “chasing payments” might be an integral part of your business as a solo professional. You wouldn’t want to deal with late payment issues on top of all that.

Invoicing and managing payments by yourself is time-consuming and stressful enough. So, what’s the best way to approach the subject, and ask your customers for unpaid invoices? Keep reading to see a comprehensive guide that includes tips, tricks, and 5 overdue payment email samples you can use. Not to mention how taxing it can be for your mental health. Especially if your sole income is from your freelancing business, this can cause serious financial anxiety. In 2017, 79% of small businesses couldn’t pay for themselves due to late payments. There are a lot of ways a delayed payment can harm your business, be it self-owned, or corporate. Trust me, I’ve been through it more times than I can count myself. No matter how good you are with your business, you’re bound to come across issues with overdue payments. According to a survey conducted by us at Ruul, %53 of the 30,000 freelancer participants received a late payment four or more than four times in a year.

0 kommentar(er)

0 kommentar(er)